Tax Avoidance vs. Tax Evasion: What’s the Difference?

No matter how diligent you are with your taxes, understanding the difference between tax avoidance and tax evasion is crucial. While they sound similar, their consequences are vastly different.

What Is Tax Avoidance?

Tax avoidance is the legal practice of minimizing your tax liability within the framework of CRA regulations. This includes strategies such as contributing to RRSPs or TFSAs, claiming tax credits, and pension income splitting.

However, aggressive tax avoidance can attract CRA scrutiny. The line between legal tax planning and questionable tax schemes can be thin. Consulting a tax lawyer ensures your strategies remain compliant with Canadian tax laws.

What Is Tax Evasion?

Tax evasion, on the other hand, is illegal. It involves deliberately misrepresenting your financial situation, for example, underreporting income, inflating expenses, or hiding assets offshore. The CRA aggressively prosecutes tax evasion, and penalties can include hefty fines or imprisonment.

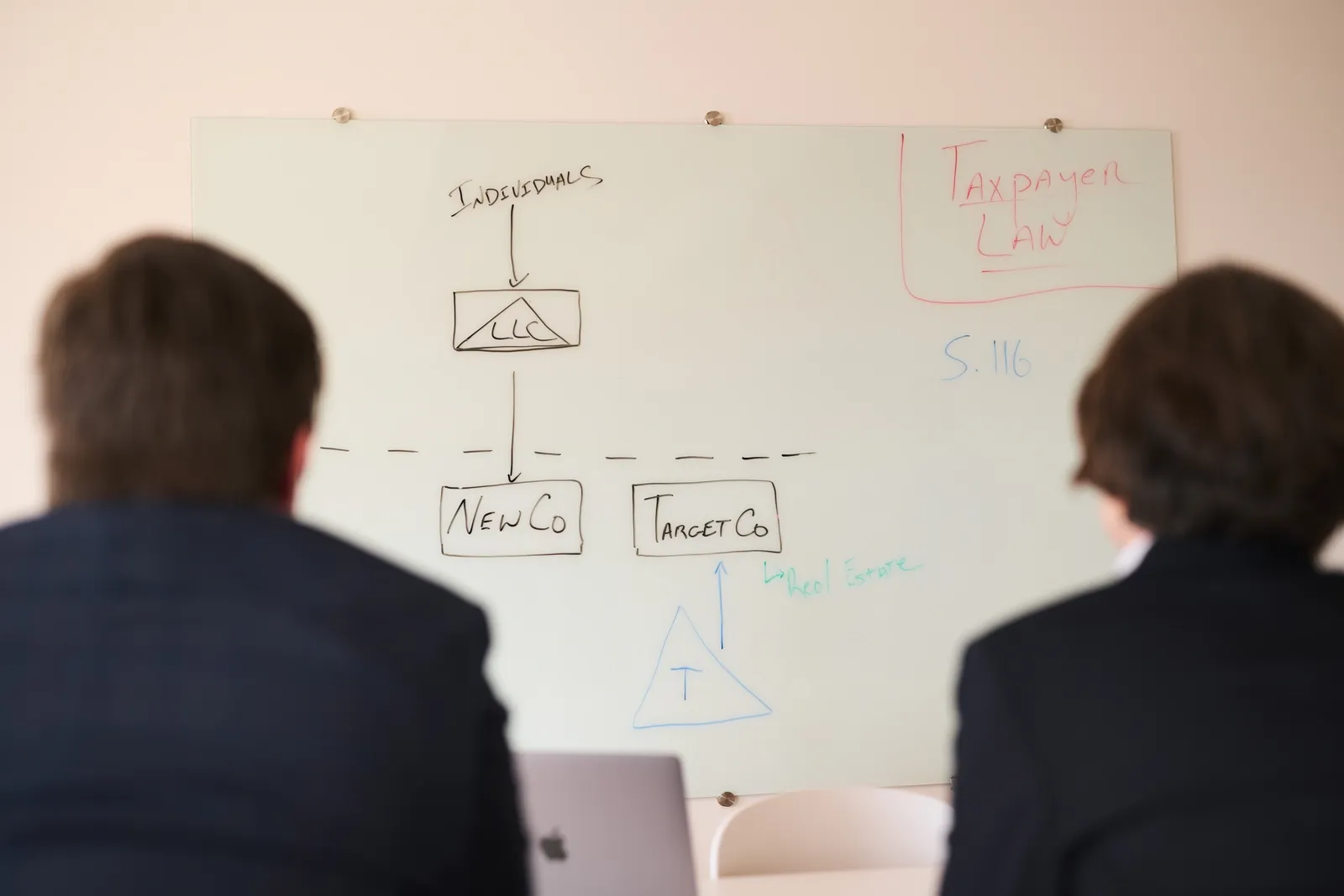

Get Taxpayer Legal Representation

Understanding the distinction between tax avoidance and tax evasion is essential. If you’re unsure whether your tax strategies comply with Canadian law, consult a tax lawyer. Legal guidance can help protect your finances, and your future.

At Taxpayer Law, we provide expert legal support to help you stay compliant and avoid tax-related pitfalls. Contact us today to safeguard your rights and financial well-being.